If you run or are starting an e-commerce business, you might have heard the term “minimum order quantity,” or MOQ, floating around. If you have heard of it, chances are you feel conflicted.

There’s advice for and against this method. This makes it difficult to decide whether it’s the right choice for you, especially if you don’t understand how it works and how it can make you money.

In this post, you’ll learn what an MOQ is, how to set one that won’t make your customers run for the hills, and how to use the strategy to increase your profits and reduce your expenses.

What Is Minimum Order Quantity?

Before we jump into the good stuff (like how to make money with an MOQ), let’s dive into the minimum order quantity definition.

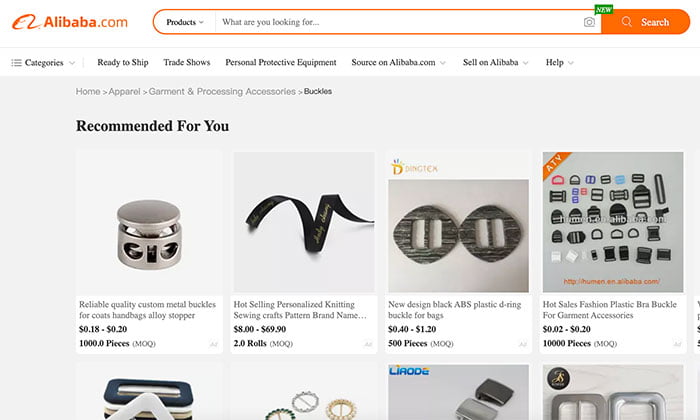

An MOQ refers to the minimum amount someone can order from a business.

For example, imagine you’re a wholesaler on Alibaba. You create an MOQ of 100 units, which means your customers need to purchase 100 units or more to do business with you.

You can also make your MOQ a dollar amount. For example, your customers need to spend a minimum of $500.

Why would you want to use an MOQ? Simply put, it protects your business and profit margins. If someone wants to order only five items from you, it’s sometimes uneconomical to start the production process. If you do, you’ll end up losing money.

With an MOQ in place, it ensures you’re covering production costs and making a profit.

Do MOQs only work for manufacturers or wholesalers? No. You can apply MOQ strategies in direct to customer circumstances as well. For example, you can set a minimum spend to qualify for free shipping or product.

How to Calculate Your MOQ

Calculating your MOQ is tricky.

It’s a key part of maintaining inventory control, but it differs wildly from business to business. There’s no fixed formula to calculate your MOQ, so you’ll need to customize it to your business.

How do you do this?

Follow the steps below to create your unique MOQ formula.

Step 1: Calculate Demand

Forecasting demand is at the core of your MOQ formula.

You need to consider your different products, seasonality, competition, and any other factors that will affect how many units you’ll sell.

The data can help you plan out your next purchasing order from suppliers and your production turnaround to make sure you can match demand.

Other things to take into account include:

- total time to ship your inventory

- freight transit times

- production times

- other delays that could affect your ability to meet the demand

Example: You sell phone cases and determine you’ll move 10,000 units each quarter. However, your sales are seasonal. During Q4, you sell 15,000 due to the Christmas demand, and your sales drop to 5,000 units in Q2. On average, your phone cases take one week to produce and ship.

Step 2: Calculate Your Break-Even Point

Next, you want to work out your break-even point.

This is the minimum number of products you would need to sell to recover your costs and start making a profit.

It’s the sweet spot where your revenue from sales exceeds your costs.

Example: If you sold five phone cases, how much revenue would that bring in compared to what you spent on production, salaries, and other expenses? You determine you need to sell 100 cases to break even.

Step 3: Calculate Your Holding Costs

Your holding or inventory costs is the price it costs to store your products before shipping to a customer.

It will cost you more money to hold your inventory over extended periods. The quicker you can move items, the lower your holding expenses and the higher your profit margin.

However, not all goods carry the same holding cost.

Some might require refrigeration, which will increase your electricity bill, while other items like phone cases can sit on a shelf for months at room temperature.

Example: You determine it costs you $2,000 per month to store 500 phone cases.

Step 4: Calculate Your MOQ

With all the data collecting out of the way, it’s time for your final calculation.

Let’s say your phone case customers currently purchase on average 200 units.

You need to sell 100 units to start making a profit.

You can make your minimum order quantity 200 units. It will cover your break-even point of 100, and you could drop your MOQ to 150 if you need to and still make a profit.

What Are the Benefits of Requiring an MOQ?

As a manufacturer and seller, there are many benefits to switching to an MOQ business model to boost your bottom line.

The main benefits of MOQ include:

- Cash flow: Worried about investing too much money in stock and it not selling? A minimum order quantity means you have less cash tied up in raw materials or product that isn’t moving. You can balance your costs and profit with item amounts your customers will accept, thus reducing waste and unnecessary expenses.

- Low inventory: You don’t want your product inventory to sit on a shelf collecting dust. By implementing an MOQ, you can lower the number of finished items in your warehouse. The less time you store your products, the less money you spend on holding costs and the bigger your profit margin.

- Increase in profits: The crux of MOQ is demand. You’re not guessing how much product or raw material your customers want. You have a clear idea of how much stock you can realistically move. Using your MOQ to find a balance between supply and demand, you can produce in larger quantities, bring your overall costs down, and increase your profits.

- Move lingering stock: Another benefit of the MOQ module is its ability to move stock. If you’re sitting with 100 phone cases and selling them one by one, it could take months to empty your inventory. By setting an MOQ of 50 or 100, it would only take one or two customers to clear out your lingering stock.

- Lower shipping costs: If you’re constantly shipping in raw materials or product to create your items, your freight costs will be high. However, when you set your MOQ at an optimum level, you’ll ship more product in bulk and lower your shipping expenses from suppliers.

5 Tips for Making Money by Requiring an MOQ

Okay, let’s get to the good stuff! We’ve gone over the MOQ definition, the benefits, and how to create an MOQ formula for your business.

Now we’re going to discuss how you can start making more money by requiring an MOQ from your customers.

I know it can seem daunting to set one. What if you scare your customers away and no one opts in? If that thought is swimming around in your head, here are my top tips for implementing an MOQ and increasing (not decreasing) your profits.

1. Eliminate Bargain Hunters

MOQ isn’t only about improving your profit margin. It helps you find a small number of customers who are happy to spend more money with you.

No matter what type of business you’re running, it’s often easier to have a small number of high-paying clients than dozens of low-paying clients. Small or once-off customers mean it will take you much longer to reach your desired income goals while taking up more time and energy along the way.

MOQs help you weed out all the bargain hunters who want the lowest possible price and make room in your garden for repeat clients who are happy to spend larger amounts with your business.

Say hello, recurring revenue, and goodbye to an unstable income flow.

Why should you care about generating recurring revenue?

- Loyal, repeat customers are worth 10x more than their first purchase.

- Increase your customer retention rate by 5 percent, and you can increase your profits by 25 percent.

2. Increase Spend on Your Orders

Want to incentivize your MOQs? Encourage your customers to spend a minimum amount by offering a discount.

You can:

- Reduce the cost per unit for a higher spend: For example, sell three bottles of shampoo for $60 instead of $30 each if purchased separately.

- Offer a minimum free shipping minimum threshold: For example, most online retailers will offer free shipping if you spend a minimum amount. It encourages customers to spend more to meet the requirement.

3. Make Pricing Attractive to Boost Inventory Turnover

Your MOQ will only work if the price is right.

You need your price per order to be enough to cover your expenses and make a profit, but it still needs to attract customers. If your minimum order amount is too high, you won’t get any orders, and you’ll sit with inventory for longer, driving up your costs.

After you’ve figured out your MOQ formula, do your market research. See what your competitors are offering and confirm a high enough demand before you start spending money on things you can’t recover, like warehousing.

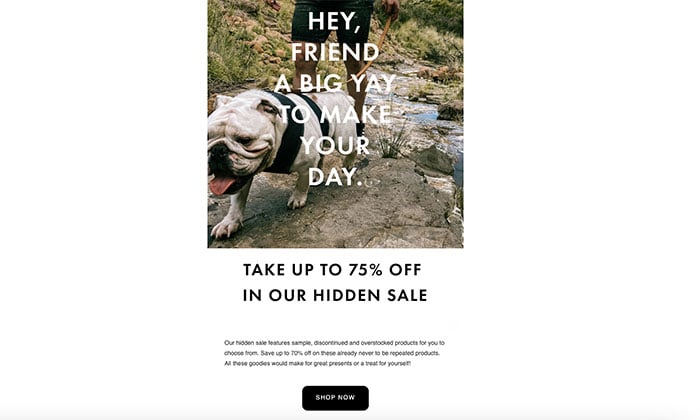

4. Move Old Stock With Flash Sales

What happens if your stock isn’t moving? Maybe there is a lull in the season, or you’ve tried a new product variation, and not enough people are biting.

One of the best ways to recoup your money and free up your inventory is with flash sales.

An excellent example of how well flash sales can work is Black Friday. Activewear giant GymShark frequently uses this strategy during the biggest sales day of the year and has broken in-house sales records by generating $400,000 in 60-minutes.

A well-executed sale can do more than move excess inventory or help you break even on poor-selling items. When done right, it can also increase customer loyalty and customer acquisition, which will boost your profits in the long run.

5. Have a Good Inventory Management System in Place

An essential part of any business is automation. It helps you do more with the same number of hours in the day and focus on the actions that move the needle forward.

When using an MOQ strategy, your success relies on having a good inventory management system in place. With a few clicks of your mouse, you can set reorder points for specific items, streamlining your inventory management process.

Other advantages include:

- Keeping your customers happy by maintaining healthy stock levels and quick turnaround on orders.

- Track your inventory turnover ratio to make better use of your resources.

- Save money by avoiding tying too much money in inventory and not having enough inventory to complete sales orders.

How to Calculate Your MOQ

- Calculate Demand

Predict the number of sales you’ll make. To calculate this figure consider the products you’re selling, seasonality, competition, shipping time, and any other factors that may affect your sales figures.

- Calculate Your Break-Even Point

Determine the number of products you have to sell to make a profit.

- Calculate Your Holding Costs

Figure out how much it costs to store your products before sending them to customers.

- Calculate Your MOQ

Figure out how many units you have to sell to turn a profit, how many you predict you’ll sell, and determine your MOQ accordingly.

Conclusion

What’s one of the most off-putting things about starting a business? Capital.

Not all of us have access to a lump sum of money to invest in an idea, and the thought of going into debt for a business that isn’t seeing results yet is terrifying.

With a minimum order quality strategy in place, you can reduce your upfront capital amount, cost per unit, and expenses like storage costs. The MOQ that works for your business is unique, and finding it requires research, planning, and understanding demand in the market.

However, once you have it, an MOQ can help you scale, avoid unnecessary expenses, and run a profitable business.

Capital isn’t the only thing you need to start a successful business; you only need a great digital marketing strategy in place. If you need help with that aspect, reach out to our agency!

Do you think minimum order quantity is a good business strategy? Why or why not?