The problem with selling your startup is the long exit time. Sometimes it can take as long as seven years before you can sell your business and hop on the next idea.

And the investors? They feel the same way.

Who wants to wait almost a decade to buy a startup when the face of tech is evolving at such a rapid pace? Plus, the price tag on those more established businesses often run into the billions.

That’s an expensive mistake if you make the wrong investment.

The solution? Micro startup acquisitions.

From Facebook to Microsoft, there is a massive trend to seek out tiny teams of five or less, buy them, and use the technology and talent to gain a competitive edge.

In this guide, we’ll discuss the benefits of buying and selling a micro startup, the trends changing M&R strategy, and the top tools you can use to sell (or buy) your startup.

But before we dive into that, we need to look into what micro startup acquisitions are and why you need to sit up and take notice.

Micro Startup Acquisitions: What Are They, and Why Should I Care?

Micro startup acquisitions are a move away from buying businesses with established products or even proven revenue streams.

Instead, larger tech companies like Twitter and Pinterest are making investments in small startups. These businesses usually consist of 2 to 3 people, and companies are taking bets on their products that aren’t even fully realized yet.

Why?

Companies are becoming more proactive and want to acquire complementary products earlier on in their road maps as a way to outwit the competition and obtain the best talent in the industry.

What does this mean for startups?

Your exit strategy timeline is A LOT shorter. Gone are the days of waiting 5, 7, or 10 years to sell, making it more affordable than ever to bootstrap your startup.

Hike Labs was founded in 2014, and by 2015, Pinterest had swooped in and acquired the San Francisco-based mobile publishing startup.

Micro Startup Acquisition Trends

Over the last couple of years, there have been clear trends in why big companies are choosing to invest in these small teams and use them as part of their growth strategy.

More deals are about gaining access to new capabilities or markets. While it’s a trend across sectors, it’s picking up steam in tech where companies are looking to deliver more complete solutions to consumers.

These acquisitions, which focus more on scope than scale, accounted for 90% of tech deals in 2019, which is a 40% increase from 2015. It’s a clear indicator that businesses want to expand their offerings and capabilities.

It’s Harder to Build the Right Product from Scratch

No one wants to be late to market.

Yes, the tech giants could develop the software these micro startups are making, but by the time it’s ready for market, a competitor might have rolled a similar product out and taken all the glory.

Or you could make the mistake of investing too much in the wrong idea, and there goes money, time, and resources down the toilet. It’s usually much cheaper to acquire a startup that has done the legwork than get an idea internally developed.

By acquiring micro startups, companies can mitigate both risks and reap the rewards.

For example, HR and finance SaaS vendor Workday bought Scout RFP (a San Francisco startup with a team of 8) for $540 million.

The startup built a cloud-based office procurement system that helps customers streamline supplier management. The acquisition is a step in the right direction for Workday to compete as a holistic enterprise resource planning solution.

The Micro Startup Talent Hunger Games

It’s no secret that attracting top tier talent can take your business to the next level.

These micro startup acquisitions aren’t only about products. Sometimes it’s the talent that attracts the bigger guys. Micro teams can amplify a company’s productivity while getting rid of the learning curve which comes with new hires.

The innovation and ability to push a startup idea into production mean the team has skills and knowledge that is invaluable to an established company.

For example, when Instagram bought Luma (its first acquisition), the tiny three-person team was part of the deal. The Luma team’s knowledge in video stabilization technology was critical in launching Instagram’s complementary app, Hyperlapse.

The Attractive Price Point of Micro Startups

A massive advantage of purchasing micro startups is the price.

It’s way cheaper to go small than fund a big, established company with hundreds of employees.

And the risk of it going under? A much softer blow.

If the investment goes the same way as Jay-Z’s Tidal music streaming app, it’s a much smaller amount to write off. Plus, you get to keep the team.

For example:

Microsoft spent $200 million to acquire Accompli and only $100 million for Sunrise. When you compare that to the $7.5 billion they spent on the acquisition of Github, or their purchase of Skype for $8.5 billion, that’s quite a bargain.

The same goes for Google acquiring Android for a measly $50 million in 2005 with key employees joining the company. As of 2020, the net worth of Android is estimated to be over $2.5 billion.

The Race for Artificial Intelligence With Micro Startups

Another major trend in micro startup acquisitions is artificial intelligence. Companies in almost every sector are looking to take advantage of machine learning and integrate it into their products.

When you combine this with the shortage of AI talent, there is a race to scoop up startups and their teams who are in the early stages of funding and research.

In 2019, Facebook quickly snapped up a visual search startup called GrokStyle, who developed an app that can automatically detect decor and home furniture from a photo. When asked about the acquisition, Facebook responded in a statement that “their team and technology will contribute to our AI capabilities”.

Tools for Acquiring or Selling Micro Startups and Other Businesses

Want to cash in on the micro acquisition boom? Whether you’re looking to sell or invest in a small business, there are various tools to help you swipe right and find your perfect match.

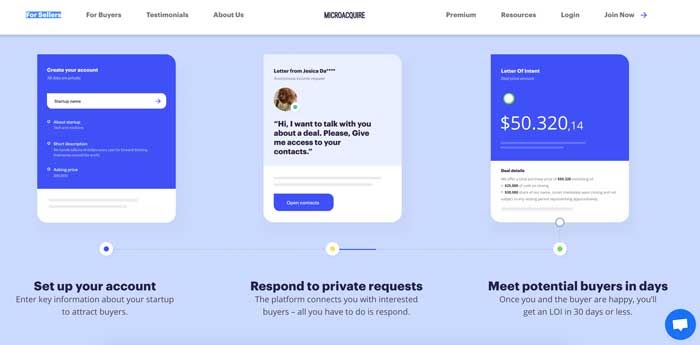

Micro Acquire

Micro Acquire is a marketplace that connects startups to buyers. The platform is free, private, and has no middlemen.

When you sign up, you’ll get instant access to over 10,000 trusted buyers with total anonymity.

The marketplace is designed to cut down on the time you need to sell your business and find startups to invest in. Once you’ve found a buyer or a seller, you’ll get a letter of intent (LOI) in 30 days or less.

Who Is It For?

Micro Aquire is for startups with an annual recurring revenue (ARR) of less than $500,000. It’s one of the best platforms for serial entrepreneurs to invest in small companies and grow them into booming successes.

Key Features

- 30-day closing period.

- Filter the listings to find a startup that ticks all your boxes.

- Sell your startup by following a quick and simple selling process.

- Each seller provides key metrics to give buyers an accurate idea about the sustainability of their business.

- No middlemen. The sale is direct between the seller and buyer.

What Does It Cost?

- Free: Micro Aquire is free for sellers and buyers with basic features.

- Premium: For $290 per year, you’ll get the newest listings sent straight to your inbox before the other buyers on the free version. It gives you the chance to review, negotiate, and snap up a deal before anyone else. Plus, Micro Acquire won’t charge any commission from the sale.

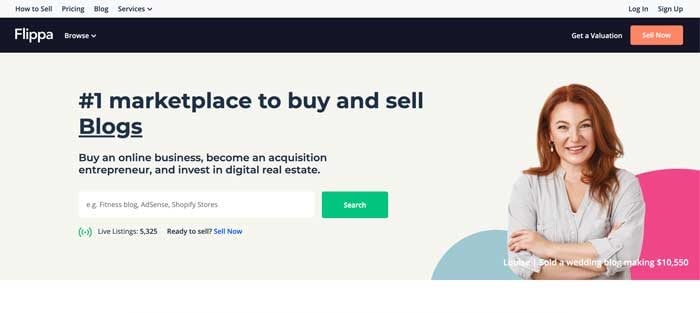

Flippa

Flippa is a marketplace for buying and selling websites, apps, domains, and online businesses.

While it helps to streamline the negotiation and transaction process, it does have a history of scam listings.

If you decide to buy on Flippa, do your due diligence and put the listings under a microscope to make sure it’s legit to find those diamonds in the rough.

Who Is It For?

Flippa is an ideal marketplace for small to medium-sized businesses. You can find a range of sellers at any price.

You can buy or sell online businesses and products like:

- Blogs

- E-commerce stores

- Affiliate sites

- SaaS businesses

- Apps

- Shopify stores

- Amazon FBA stores

- Domains

Key Features

- The easy-to-use site navigation makes it simple to list your business in under 10 minutes.

- There are tons of filtering options to help you find a business that meets your needs and budget.

- Choose the “Auction” feature to sell your business within 30 days or set it at a fixed price. Fixed price listings usually take 3-5 months to sell.

- The “Broker-Matching Service” connects you to a personal broker who will manage the entire sales process from marketing to closing the deal on your behalf. You will need a net annual profit of at least $100,000 to qualify.

- The “Self Service” feature gets you a Flippa account manager to help you with the sales process.

- Use Flippa’s free Online Valuation Tool to get a sense of how much your business is worth.

What Does It Cost?

Flippa’s listing fees depend on what you’re selling:

- Starter/template websites: $15

- Domains: $10

- iOS and Android Apps: $15

- Established websites: $49

There is also a 10% success fee on each sale, and you can upgrade your listing with various packages starting at $295.

Tiny Capital

Tiny Capital is a different breed in the micro acquisition space. Unlike some of the other tools mentioned above, it’s a traditional venture capital firm, with a twist.

Instead of buying companies and becoming a micromanaging nightmare, Tiny has a hands-off approach.

Besides the required monthly and quarterly reports, founders rarely have contact with the firm, with some businesses only speaking to Tiny Capital founder, Andrew Wilkinson, once every six months.

Who Is It For?

Tiny Capital seeks to invest in profitable internet businesses within the information technology sectors.

Think your business would be a good fit?

You need to meet the following requirements:

- 3-5 years in business.

- A minimum of $500k per year in annual profit.

- A high-quality team.

- You have a simple online business with high margins that doesn’t require complex technology or large teams

- Your business has a competitive advantage.

It’s the perfect micro acquisition option for founders who want a quick sales turn around (most deals are complete within 30 days) and an investor who is going to be seen and not heard.

Key Features

- There is a simple selling structure where you can get a full or partial cash payment upfront.

- Tiny Capital has a simple 30-day sales cycle that includes a 15-day due diligence process.

- Founders can stay or go.

- No culture change required.

- No in-person meetings before or after the sale.

What Does It Cost?

There are no upfront costs with Tiny. All you need to do is contact the team, and you’ll get a response within 48 hours. If Tiny likes your business, you’ll get an offer within 7 days.

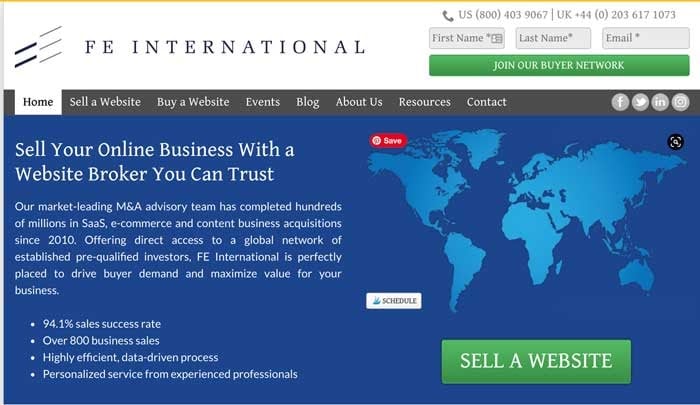

FE International

FE International is an acquisition advisory team for businesses earning five figures or more. With a 94.1% sales success rate, it’s one of the top tools for micro startup acquisitions.

As a full-service M&A (mergers and acquisitions service), the platform has integrated solutions for all the major elements of a successful acquisition. From valuation to exit planning to post-sale considerations, it’s all handled under one roof.

Who Is It For?

FE International specializes in selling websites in the SaaS, content, and e-commerce industries. It’s an excellent choice for startups within the 5 to 8 figure range who want top-tier support throughout the sales process.

Key Features

- FE has a high sales success rate compared to its competitors.

- It has a vetted investor network of 50,000 people, ensuring only qualified, seasoned professionals view information about your business.

- Several brokers are always available to minimize disruptions in the sales process.

- To help you get the best possible deal, FE International creates a thorough sales plan and marketing materials to attract qualified buyers.

- FE brokers will approach several pre-screened and vetted investors and negotiate the best deal on your behalf.

What Does It Cost?

There are no listing fees for sellers or joining fees for investors. Brokers are paid a 15% commission fee on all sales, and there is a buyer transaction fee of 2.5% with a maximum threshold of $1,000.

Empire Flippers

Since opening its doors in 2013, Empire Flippers has sold over $93,000,000 worth of websites and online businesses with an impressive 88% selling success rate.

Who Is It For?

Empire Flippers is interested in websites within the following categories:

- Google AdSense/Display Advertising Sites

- Amazon Affiliate Sites

- Affiliate Sites

- Dropshipping Sites

- E-commerce Stores

- SaaS Businesses

- Lead Generation Sites

- Amazon FBA

- Mobile Apps

- Productized Services

There is an intensive seller vetting process to ensure only quality listings make it onto the marketplace, and there is a dedicated team for each step of the process.

To qualify for a listing on Empire Flippers, you must meet the following requirements:

- Your business or website must have a 6-month solid track record of at least $1000 profit per month.

- You must be using Google Analytics for the past 6 months.

Key Features

- Empire Flippers has a dedicated migrations team to take care of transferring your new business to you.

- Get an estimate on how much your business is worth on Empire Flippers before you start the vetting process.

- New listings are sent out via email to a list of over 45,000 people.

- If you list with Empire Flippers, you will need to agree to not list your business anywhere else for 2 months. Sellers also need to sign a 3-year non-compete agreement.

What Does It Cost?

Empire Flippers has a $297 listing fee for first-time sellers. But if your listing is declined, it is 100% refundable.

If you’re a repeat seller, you’ll only pay $97 to list your site.

Potential buyers must pay a refundable 5% deposit fee to gain access to a listings URL, P&L, and Google Analytics.

There are commission fees ranging from 8% to 15% depending on the final sale price.

Conclusion

The race is on for micro startup acquisitions.

Companies who understand the benefits of expanding their scope by adding complementary products and talent to their portfolio will reap the rewards.

Companies who forgo adding micro acquisitions as part of their mergers and acquisitions strategy are going to get left in the dust by competitors and struggle to find top-tier talent.

In short, there is no better time to be a desirable tiny startup.

Have you ever sold or acquired a micro startup? What has been your experience?

The post Micro Startup Acquisition: The Definitive Guide to Buying and Selling Small Startups appeared first on Neil Patel.